Insurance Claim & Dispute Lawyers

Resolving insurance disputes for property owners and businesses

Trusted Insurance Dispute Lawyer in Melbourne

We are expert insurance lawyers with a unique focus on strata building insurance, home and property insurance, contract works insurance, professional indemnity insurance of building surveyors, professional indemnity insurance of engineers, architects and plumbers insurance including the Licensed Plumbers General Insurance Order 2002.

We file proceedings in Court and at the Australian Financial Complaints Authority and are industry leaders in denied insurance claims whether for homeowners, professionals or major corporations.

Professional Indemnity insurance

Most professionals are required to hold professional indemnity insurance but this does not mean that if you suffer loss that an insurer will pay. These policies can be highly complex and vary greatly between insurer and professional as to the coverage.

We regularly act for engineers and other design professionals and financial professionals who hold professional indemnity insurance or can advise property owners or builders who are considering a claim against a party holding professional indemnity cover.

Property insurance claim denials

BU Lawyers have significant experience in reviewing, advising and advocating in domestic and business insurance claims.

Before making a claim or contesting an insurer's decision it is first imperative to understand if you have a legitimate legal ground to make a claim or to contest an insurer's denial before taking action.

AFCA

One avenue to pursue a dispute with an insurer is at the AFCA and this is often a low cost avenue of resolving disputes if your insurer denies your claim. This will lead to a decision from AFCA which as a final determination will be binding on the insurer if you choose to accept it. Generally, AFCA will consider claims up to $1 million and compensation up to $500,000. These are substantial increases in the terms of reference of AFCA.

Whether you are a policyholder or a financial service provider (FSP) it is imperative to obtain expert advice prior to filing your complaint or lodging a response. The stakes at AFCA are increasing.

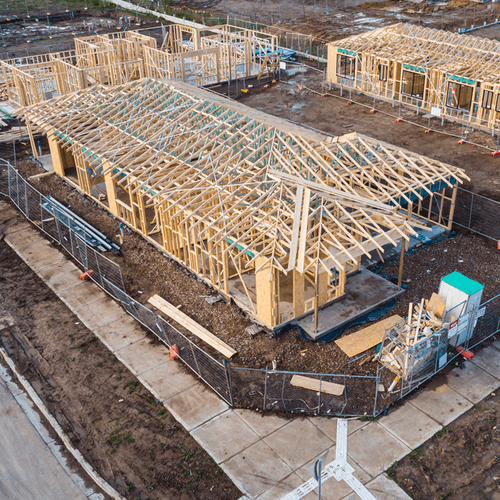

Domestic builders warranty insurance

Domestic Building insurance (DBI) or domestic builders warranty insurance as it is commonly called provides cover for incomplete and/or defective building work.

In Victoria, builders are required to arrange DBI for work valued at over $16,000.00. This insurance does not respond unless certain trigger events have occurred as in the builder having died, disappeared or become insolvent.

We also act in plumbing insurance claims and have had significant experience with building, mould and defect related claims.

Dispute process

With extensive experience in commercial, and building and construction law, we are committed to providing clear and effective legal solutions.

Arrange an appointment today to advise on your insurance claim

Book an appointmentRecent articles about Insurance Disputes

Articles coming soon